Landmark Legal Victory for Ripple as U.S. Judge Rules in Favor of XRP Cryptocurrency

In a significant development for the cryptocurrency industry, Ripple Labs Inc has been deemed not to have violated federal securities law by selling its XRP token on public exchanges. The ruling, delivered by a U.S. judge on Thursday, resulted in a landmark legal triumph that propelled the value of XRP to new heights.

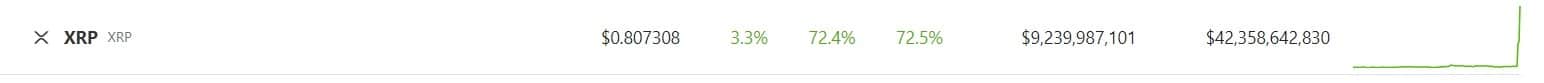

Following the ruling, XRP experienced a surge of 25%, as reported by Refinitiv Eikon data.

While this ruling represents a substantial win for Ripple Labs, it also holds a partial victory for the U.S. Securities and Exchange Commission (SEC), which has pursued numerous cases against crypto developers. Ripple Labs, the most significant entity to have its case determined by a judge, was found by U.S. District Judge Analisa Torres to have violated federal securities law by directly selling the XRP cryptocurrency to sophisticated investors.

This ruling marks the first instance in which a U.S. judge has favored a cryptocurrency company by classifying certain digital asset sales as falling outside the scope of U.S. securities law.

It is worth noting that the ruling could be subject to appeal. At the time of this news, neither an attorney for Ripple nor a spokesperson for the SEC had responded to requests for comment.

The SEC’s allegations against Ripple and its current and former chief executives involved the accusation of conducting an unregistered securities offering amounting to $1.3 billion through the sale of XRP, created by Ripple’s founders in 2012.

Judge Torres ruled that XRP sales on cryptocurrency platforms by Ripple CEO Brad Garlinghouse, co-founder and former CEO Chris Larsen, and other distributions, including employee compensation, did not involve securities.

However, the judge stipulated that a jury should determine whether Garlinghouse and Larsen had aided the company’s violation of the law.

In a post on Twitter, Garlinghouse expressed his appreciation for the ruling, stating, “Thankful to everyone who helped us get to today’s decision – one that is for all crypto innovation in the U.S.

At the time of this response, an attorney for Larsen had not provided a comment.

Gary DeWaal, an attorney at Katten Muchin Rosenman, opined that the ruling would likely be advantageous for Coinbase (COIN.O), the largest U.S. cryptocurrency exchange currently engaged in its legal battle with the SEC.

The market’s reaction to the ruling demonstrates that it is a “tremendous event for the industry,” according to DeWaal.

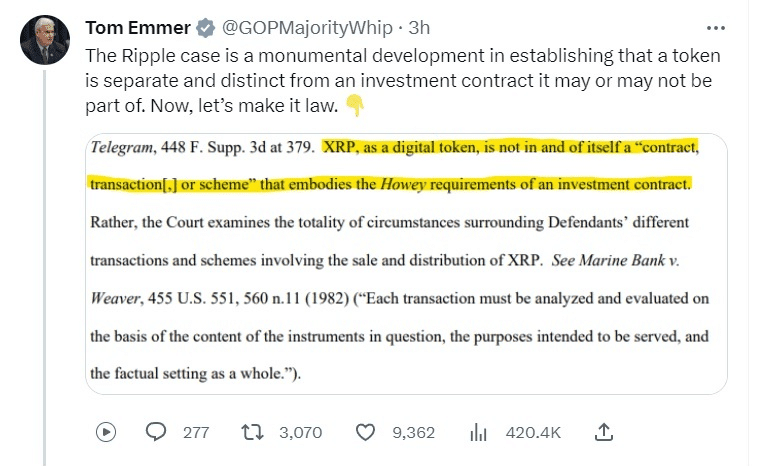

Furthermore, the ruling has reignited calls for Congress to enact legislation clarifying digital asset status.

In a Twitter post, House of Representatives Majority Whip Tom Emmer, a Republican, stated that the ruling affirms “a token is separate and distinct from an investment contract it may or may not be part of.” He added, “Now, let’s make it law.”

Twitter

Twitter Facebook

Facebook Linkedin

Linkedin